About Islamic Financial Planner (IFP)

The Islamic Financial Planner (IFP) is a training and certification programme designed especially for professionals and executives serving the retail segment of the Islamic financial market. This programme is a joint collaboration between Islamic Banking and Finance Institute Malaysia (IBFIM) and the Financial Planning Association of Malaysia (FPAM). FP has obtained Full Accreditation status by the Finance Accreditation Agency (FAA).

Be an Islamic Financial Planner

Islamic Financial Planner (IFP) is designed especially for professionals and personnel serving the retail segment of the Islamic financial products and growing demands of discerning Muslim retail clientele call for higher standards of competency and ethical practice of financial planning professionals. Equip yourself with enhanced knowledge in the personal financial advisory space.

Learning Outcomes

Upon completion of this advanced level, participants would attain a complete knowledge and have standard proficiency as an Islamic Finance professional. Their professionalism can be measured through their ability to:

- Illustrate the Shariah principles and its applications that related to Islamic financial planning

- Relate the financial planning industry and its regulatory structure

- Realize the steps and requirement in Islamic financial planning process

- Construct and strategize a holistic Islamic financial plan

- Formulate and execute implementation and review process of the plan as an ongoing advisory service

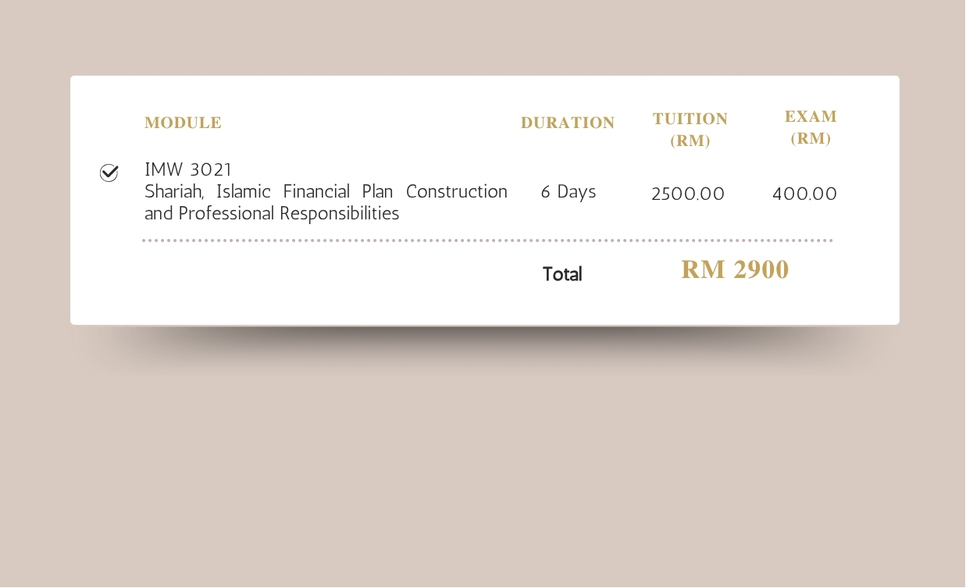

Challenge Status

Entry Requirement for IFP – Challenge Status:

- Certified Financial Planner (CFP) holders, or;

- Other professional certificates e.g. Chartered Financial Analyst (CFA), Chartered Accountant (CA), Certified Islamic Finance Professional (CIFP) or equivalent with 3 years’ experience, or;

- Bachelor’s degree holder in any discipline with 5 years of minimum experience in Islamic financial services industry, or;

- However, bachelor’s degree holders from the Faculty of Economics and Muamalat (FEM), Universiti Sains Islam Malaysia (USIM), are exempted from any experience requirements. Final-year students are highly recommended to participate

Recognition Prior Learning (RPL)

- For Candidates who are Degree holder with less 5 years experience or who are Diploma or SPM holder with 10 years minimum experience in Islamic services industry and would like to register for Challenge Status are required to apply for Recognition of Prior Learning (RPL) from IBFIM.

- Candidates can register for IFP-CS once IBFIM approved your application and issued the RPL result letter.